Peerless Info About How To Trade With Trend Lines Chart Js Line Charts

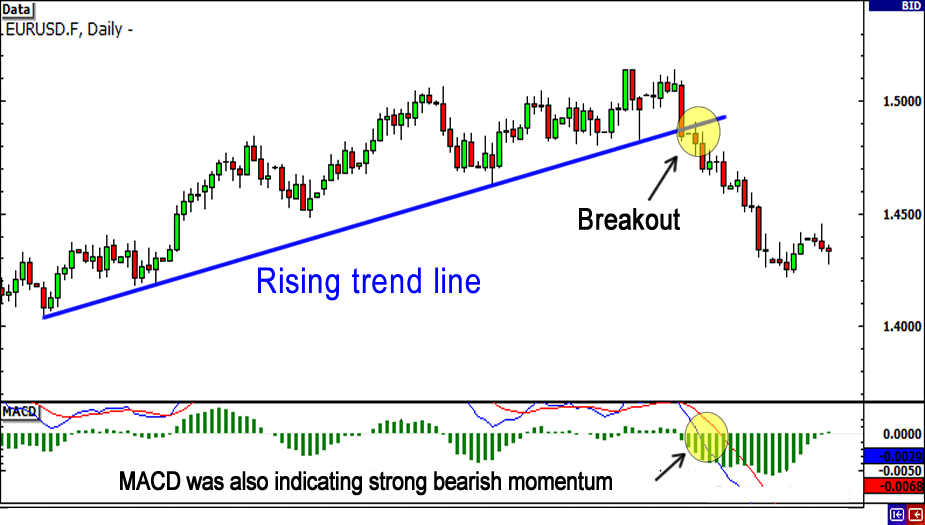

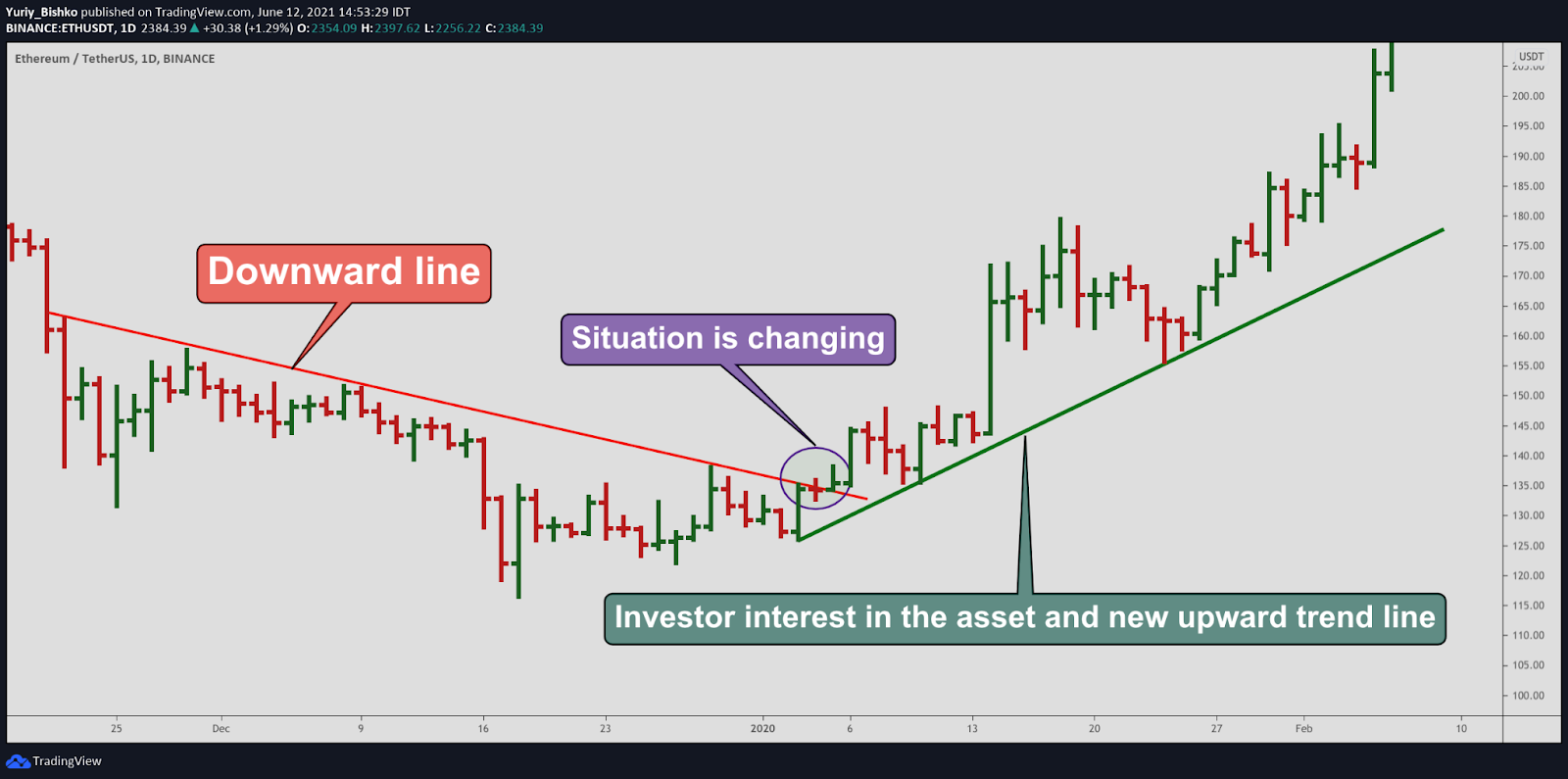

Traders wait for the price to break above or below a trend line, indicating a potential trend reversal or continuation.

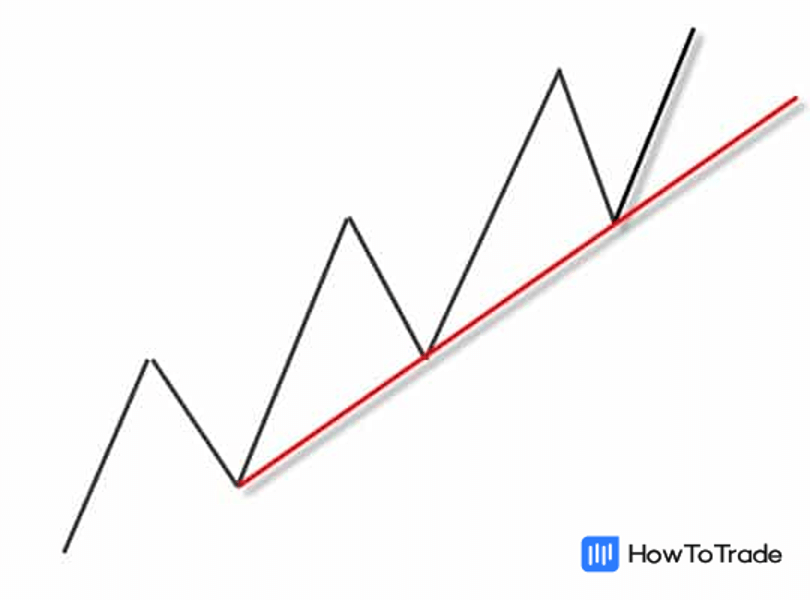

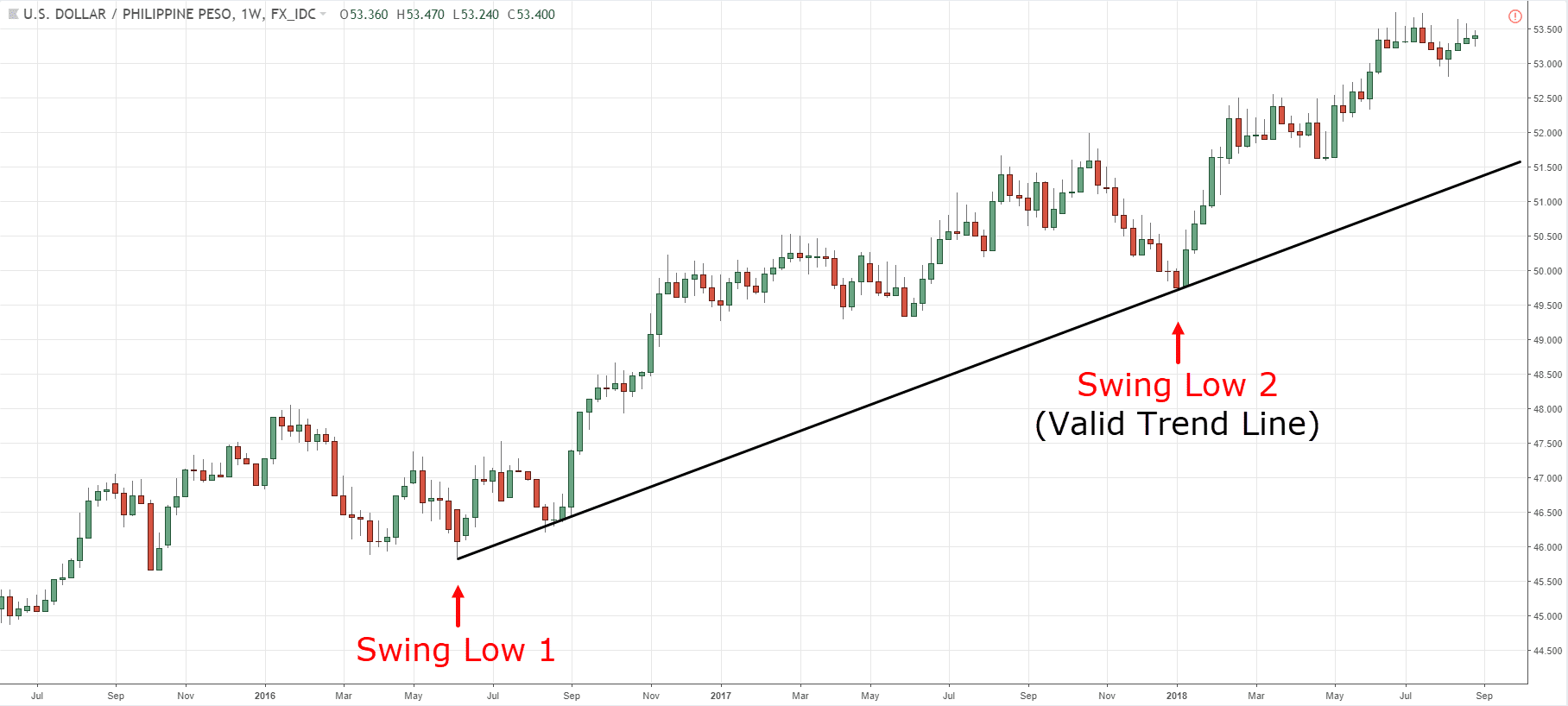

How to trade with trend lines. Trendlines are a visual representation of support and resistance in any time frame. It takes at least two tops or bottoms to draw a valid trend line but it takes three to confirm a trend line. From the simplest support and resistance the most complex pendants, once you see the trend, all that’s left is to decide if you intend to follow it or wait for its reversal.

In its copper price forecast 2025, bmi projected copper to average $9,300/tonne, up from $8,800 in 2024. How to spot and trade breakouts from trend lines. Once price reaches and touches that trendline, next thing you do is wait for bullish or bearish reversal candlesticks to form giving you the signal to place your pending sell stop or buy stop orders.

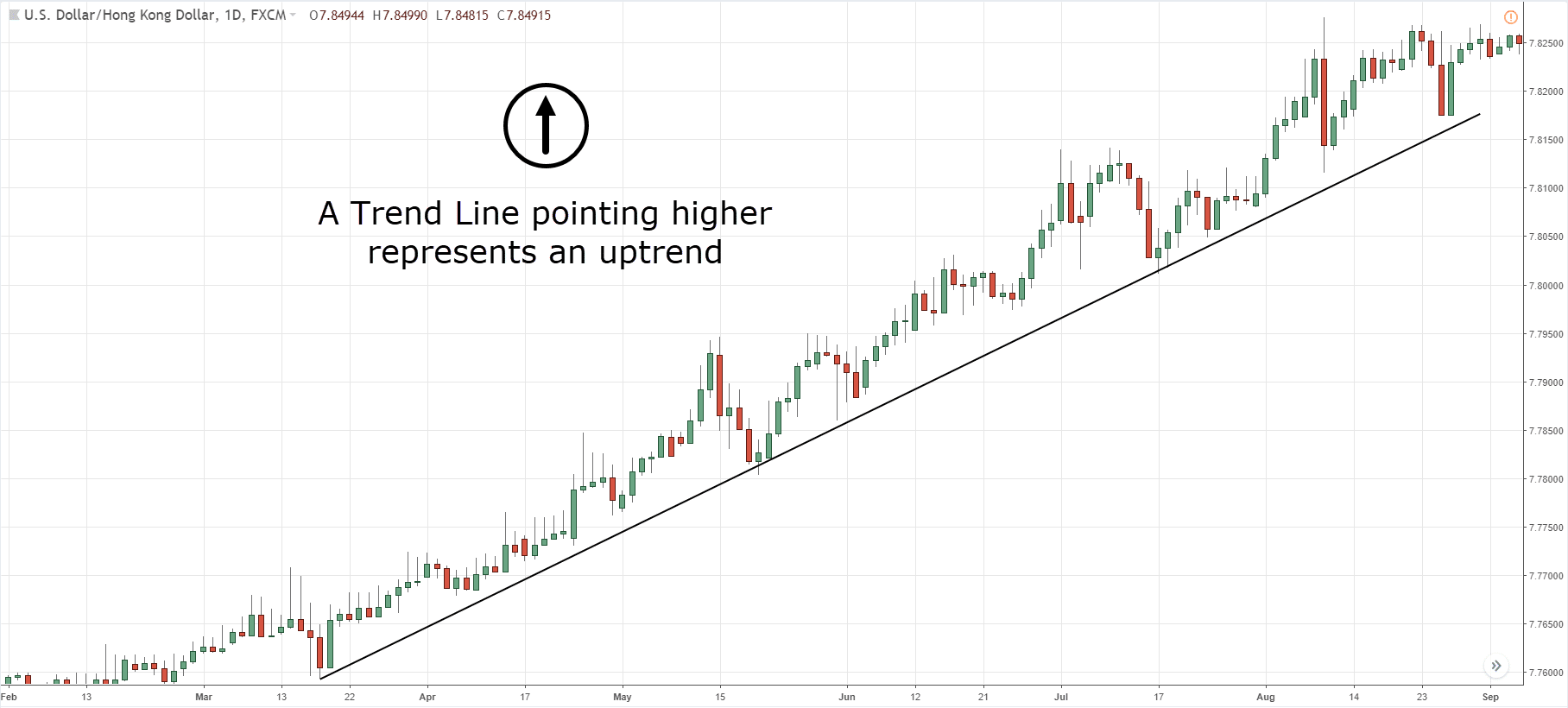

Anz research also saw copper could trade higher at $9,290/tonne in 2025, up from $8,950 in 2024. The steeper the trend line you draw, the less reliable it is going to be and the more likely it will break. Trend lines are typically angled either up or down, with the most common being an up trend (line angled up) or a down trend (line angled down).

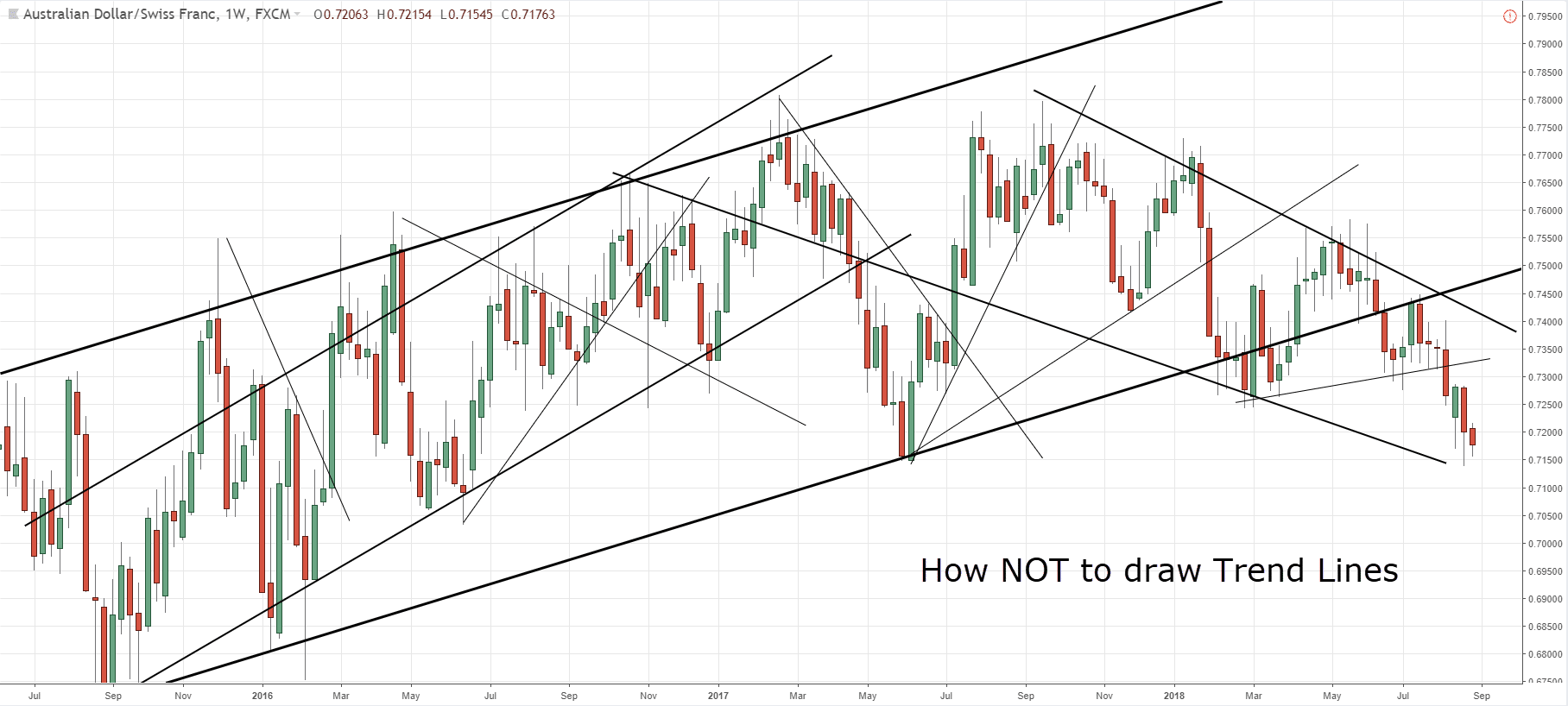

A few pointers on what not to do when learning how to use trend lines. Trend lines are drawn at an angle and are used to determine a trend and help make trading decisions. Trendlines are used to give traders a good idea of the.

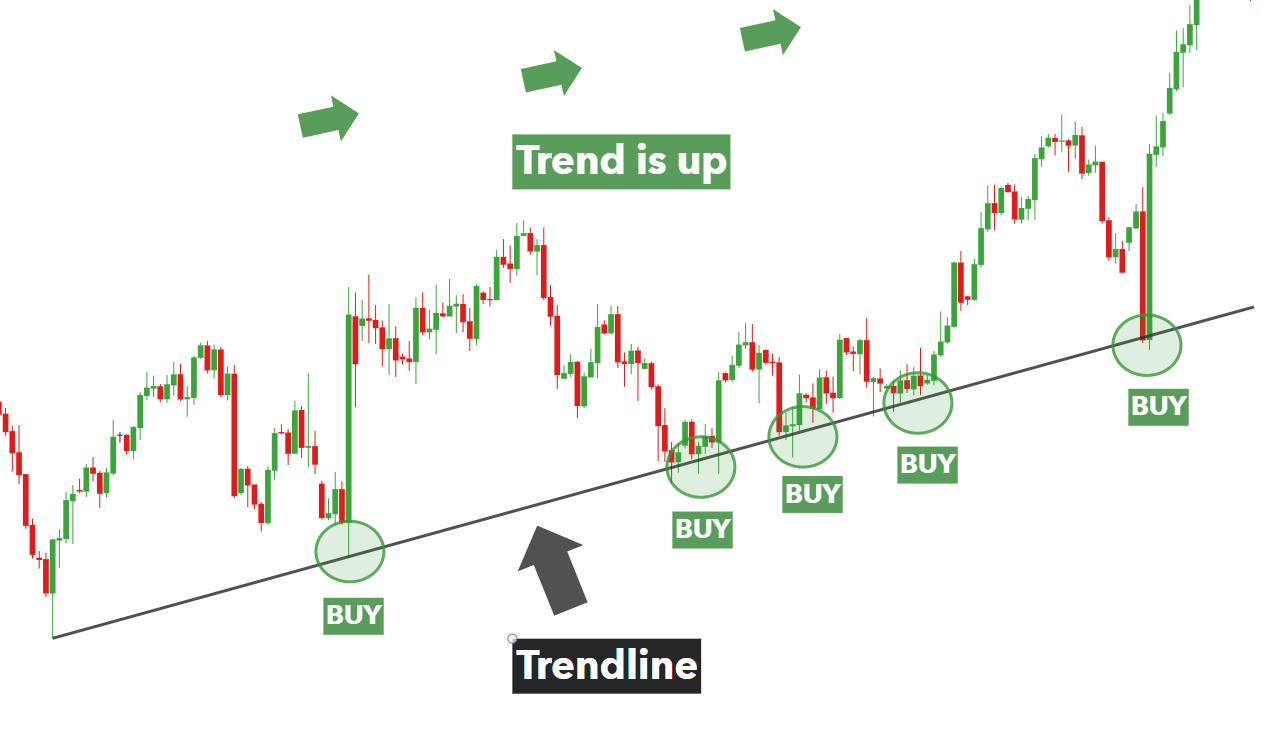

The easy way to enter, manage, and exit your trades using trend lines. While anyone can start drawing lines haphazardly on a chart, using trend lines effectively takes skill, practice, and understanding. The trendline trading strategy allows traders to consider market direction over timeframes to see how long price momentum might hold up.

Trend lines are straight lines that connect two or more price points on a chart to identify and confirm trends. A trendline trading strategy can come in the form of breakouts, price bounces, and reversal strategies. How to trade and profit from the trend lines shown in different types of trends.

Trend trading is an effective financial market trading technique because the market often moves in three major trend directions: 3 different types of trend lines every trader must know. Trend lines are one of the most universal tools for trading in any market, used in intraday, swing and position trading strategies.

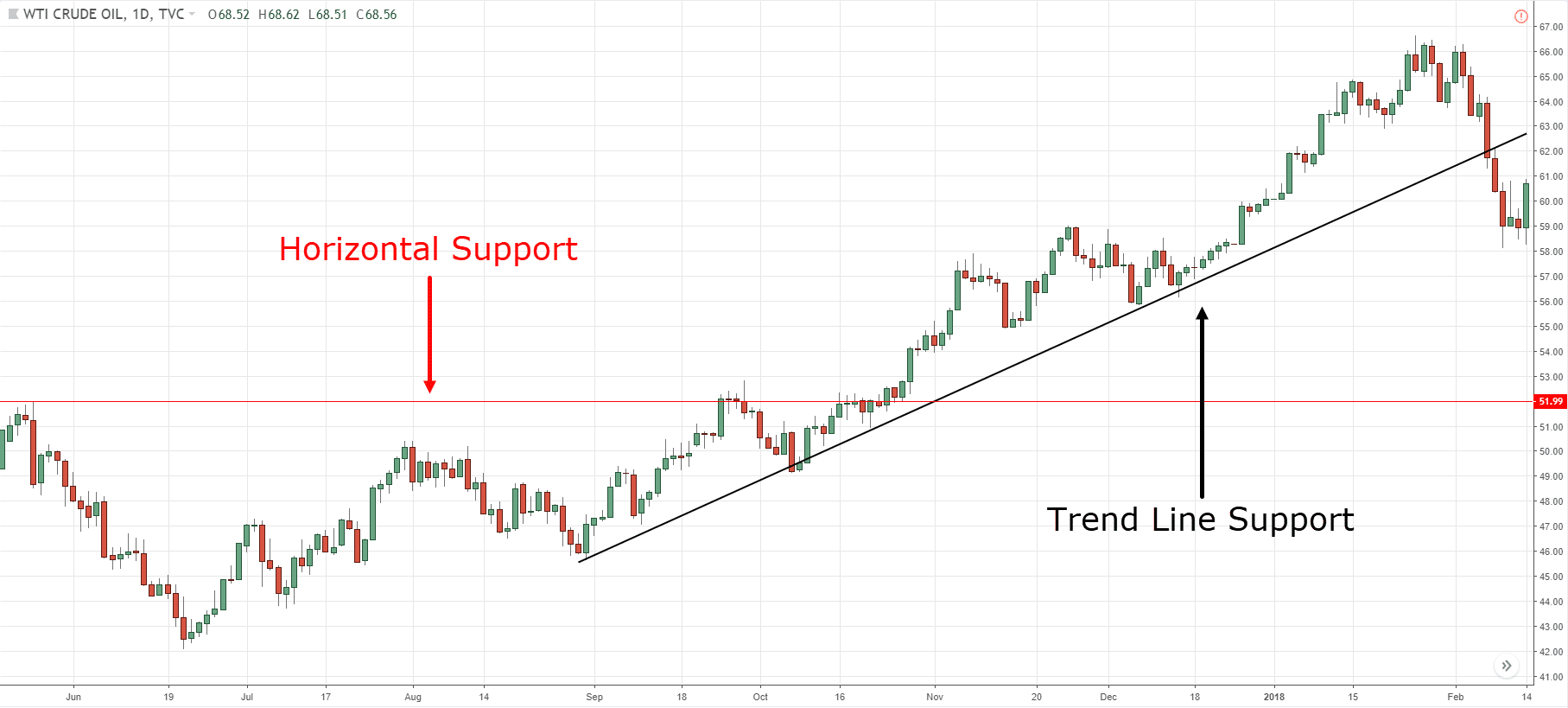

With proper trend trading skills, traders can take advantage of two of these market directions: Trendlines are a key part of delving into technical analysis and trading off of charts. Trendlines can also be used as a reference support or resistance level for stop losses or to trail profits.

Here are some important things to remember using trend lines in forex trading: In an uptrend, trend lines are drawn below the price and in a downtrend, trend lines are drawn above the price. Why aren’t all trends created equal and what you can do about it.

When used correctly, they're a helpful, clear, and relatively simple tool for traders. This information is vital for traders as it helps them align their trades with the prevailing market sentiment. What is a trend line and how to identify it.