Fine Beautiful Tips About Is Fifo Easier Than Lifo Change Data From Horizontal To Vertical In Excel

By selling newer inventory products first, the cost.

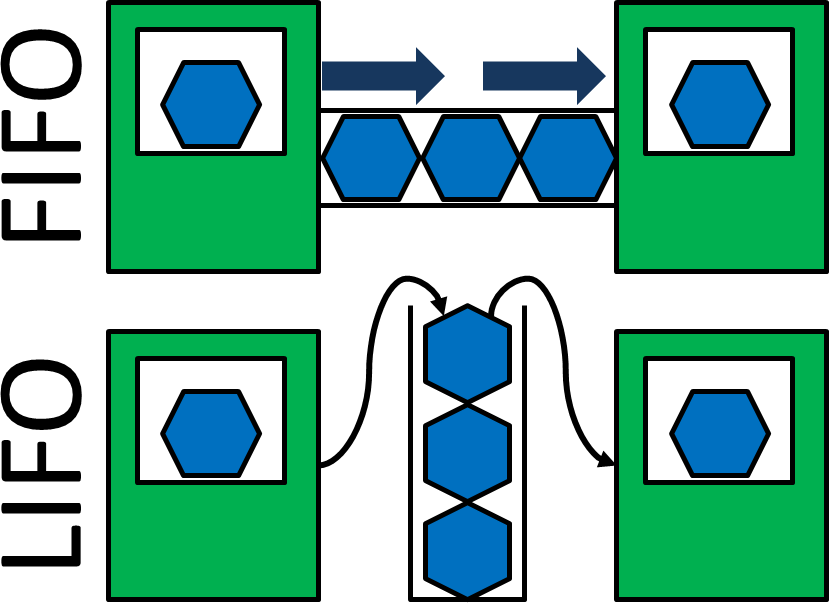

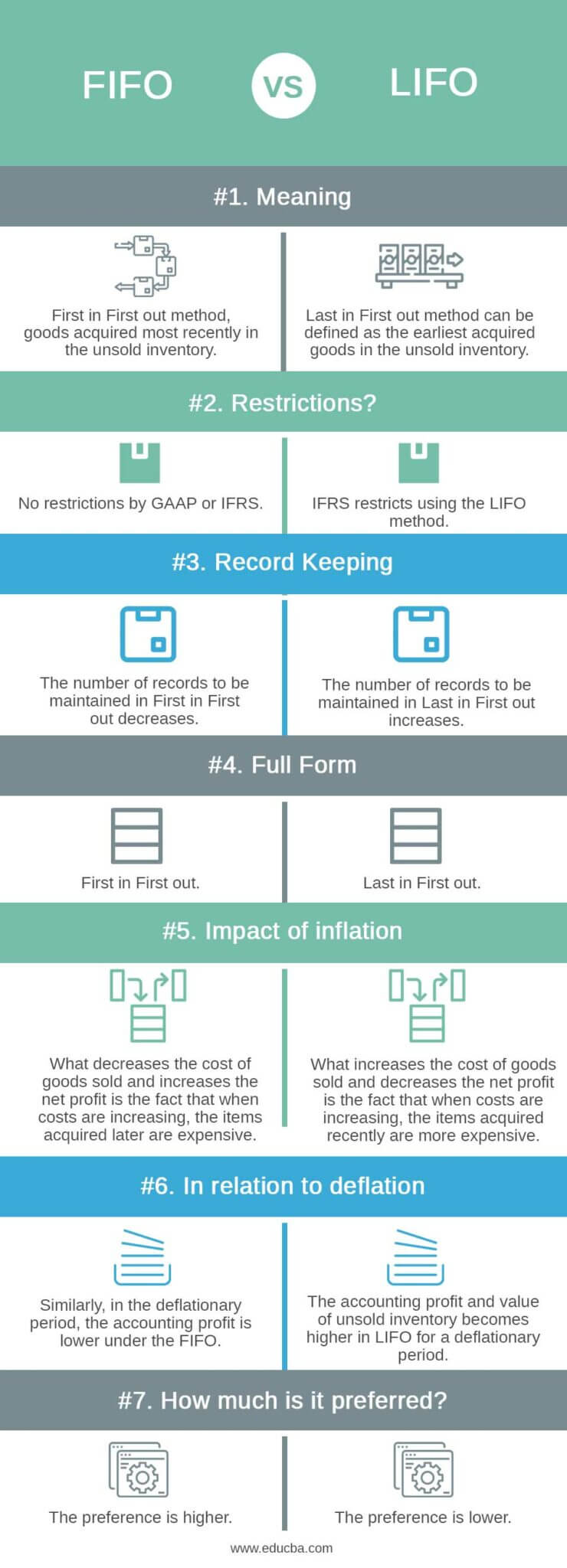

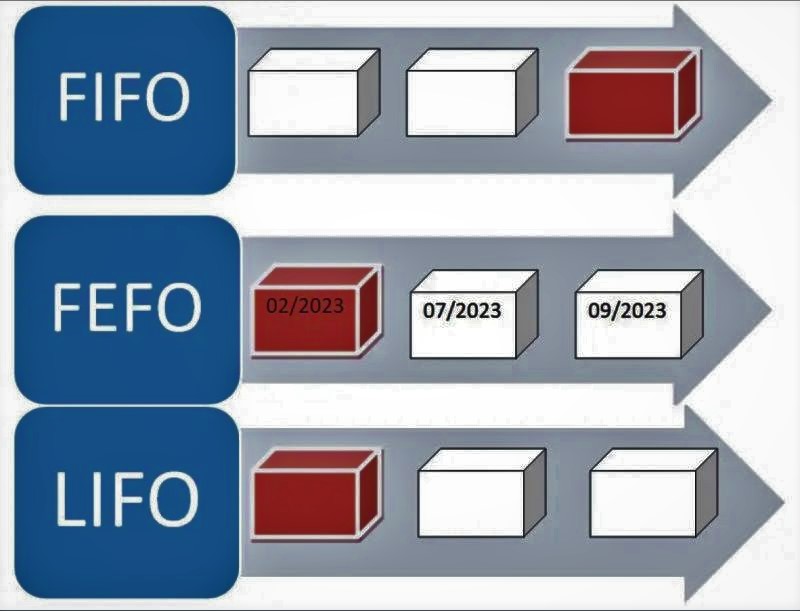

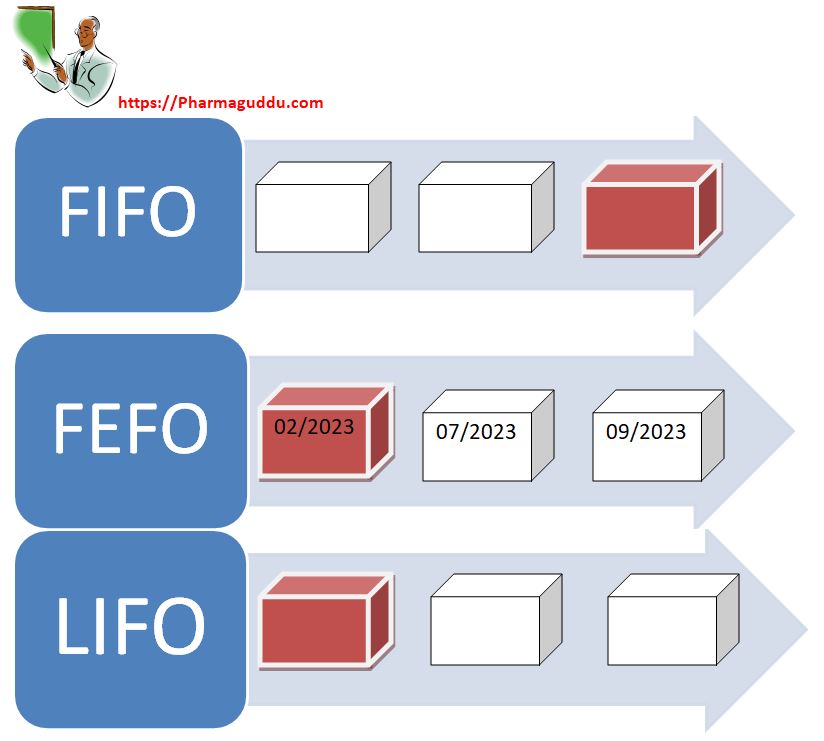

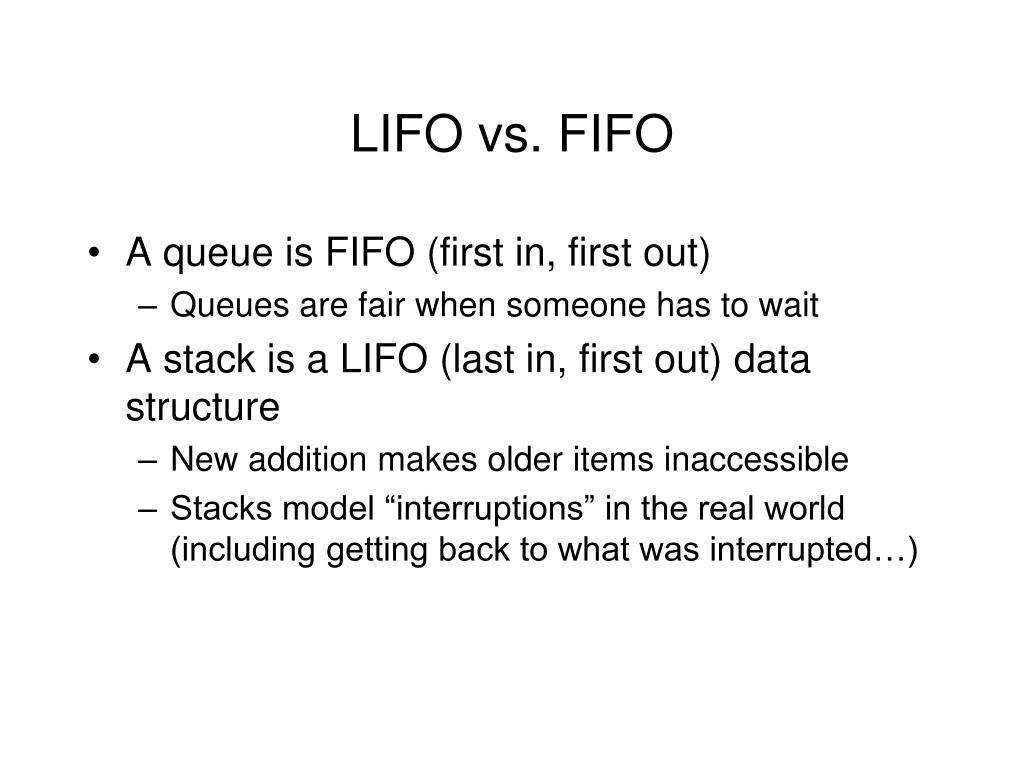

Is fifo easier than lifo. Fifo is an accounting method in which assets purchased or acquired first are disposed of first. In this fifo vs lifo blog post, you will learn: The difference between fifo and lifo is that the lifo method sells or uses the oldest inventory first while the fifo method sells or uses the newest inventory first.

The main advantage of the wac method is its simplicity. Is fifo a better inventory method than lifo? Fifo is generally accepted as the more accurate inventory valuation system.

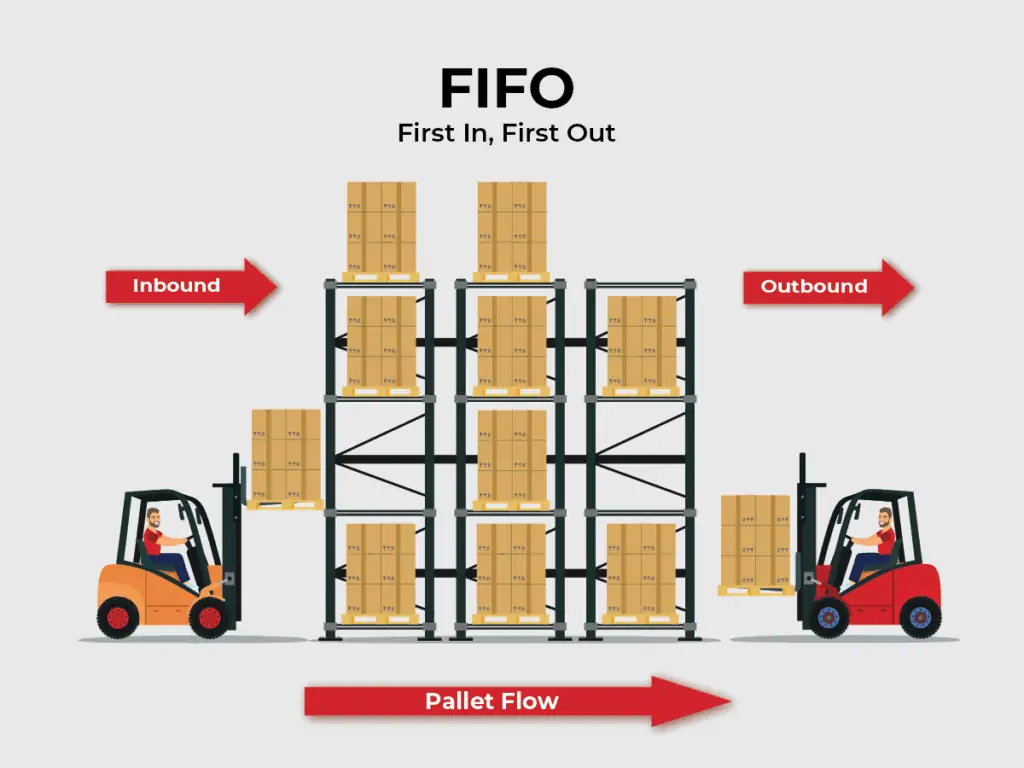

First in last out (fifo) and last in first out (lifo). The first in first out method of inventory management explains the order in which inventory is purchased and then sold. Better matching of product cost with revenue:

Amid the ongoing lifo vs. Which one is better for inventory valuation? What is lifo vs.

Fifo has advantages and disadvantages compared to other inventory methods. In certain cases, lifo might be the better choice. Difference between lifo and fifo.

Can anyone help me to understand how exactly does this formula work and what is the logic that resulted in this formula? Fifo (first in, first out) and lifo (last in, first out) are two accounting methods for the value of inventory held by the company. What kind of business you run will make a difference to the type of method that works best for you.

Fifo often results in higher net income and higher inventory balances on. If there was no inflation, the order of items sold wouldn’t matter but since realistically the prices tend to go up, using one method over the other affects your income statements and taxes. First in, first out assumes that the remaining inventory consists of items purchased last.

Regular inventory turnover tends to keep inventory value closer to market value and is a more realistic representation of how. There are a couple of ways to manage inventory, and choosing the best inventory management. See which one works better for your organization.

Fifo tends to reflect current market prices better. There are two techniques of inventory valuation: Under lifo, your reported profit is lower which decreases your taxes compared to fifo.

However, when the more expensive items are sold in later months, profit is lower. Pros of the weighted average cost method. Which method is better: