Outrageous Info About Why Is Curve Steeper And Flatter How To Edit A Line Graph In Google Docs

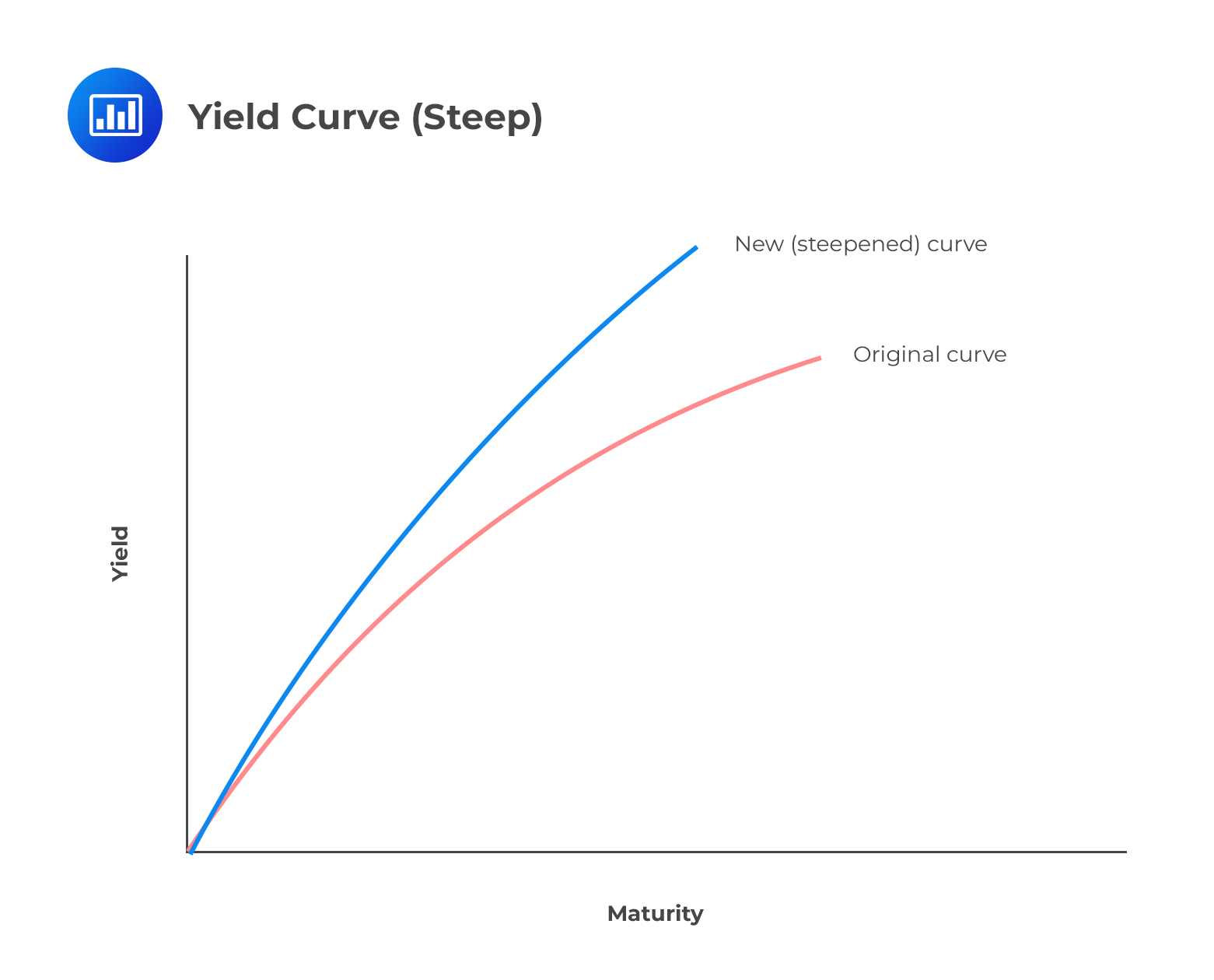

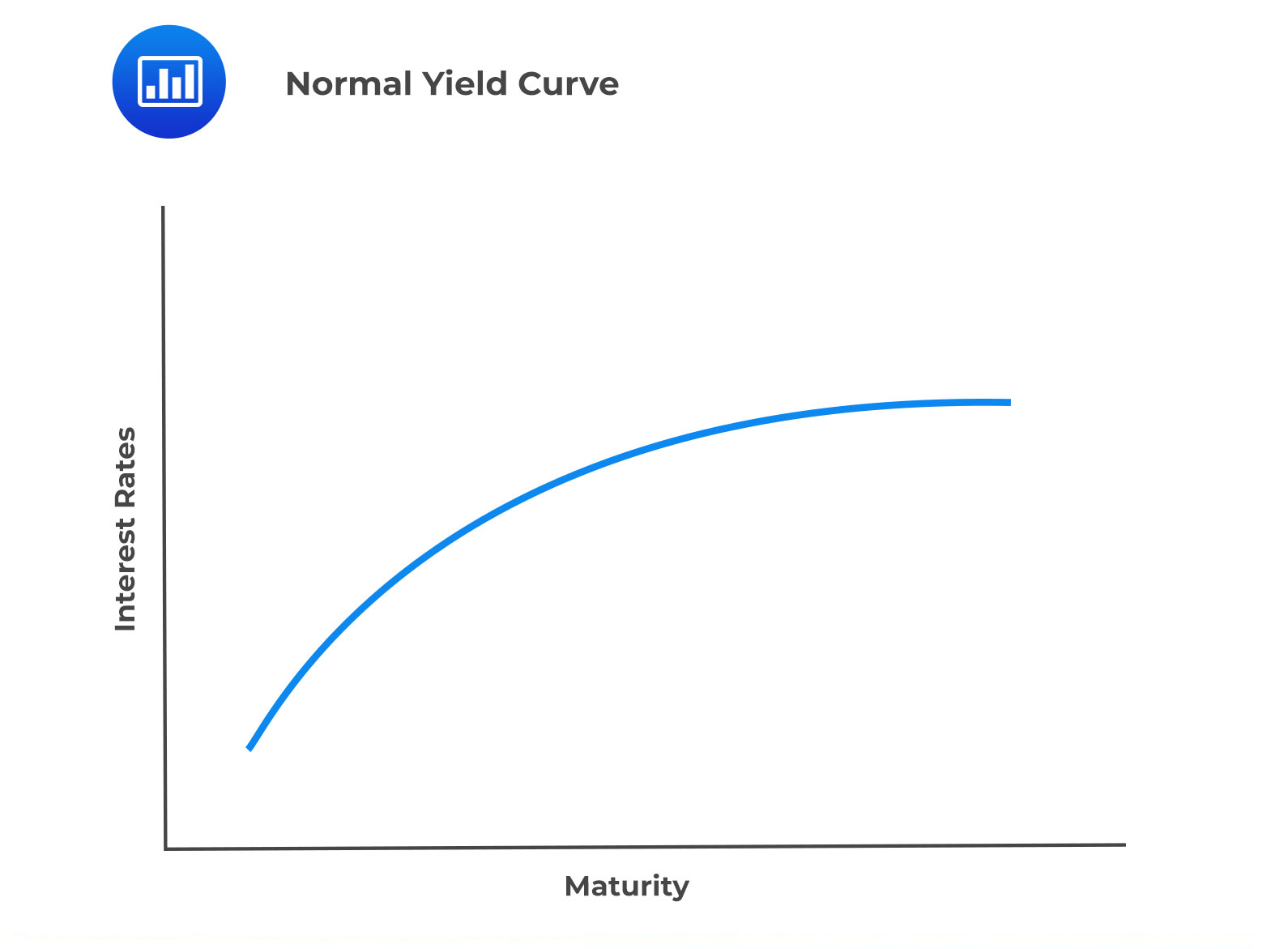

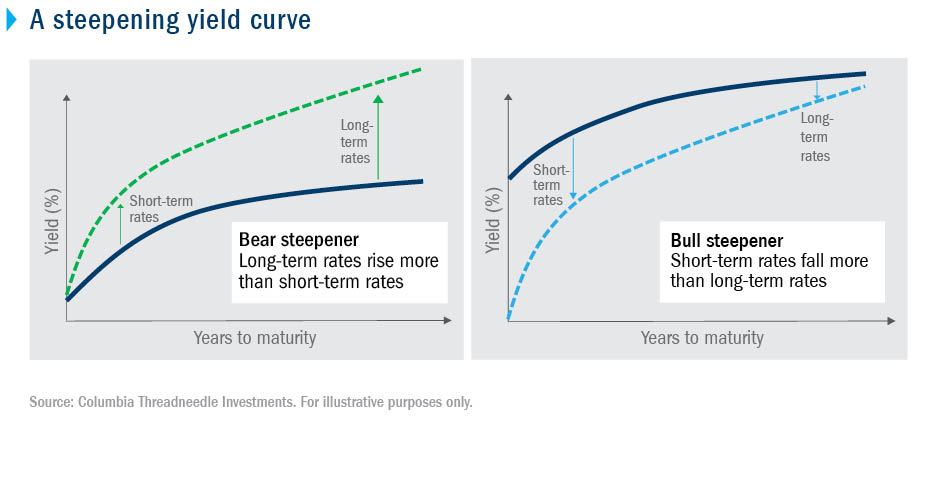

We think the us yield curve can steepen further.

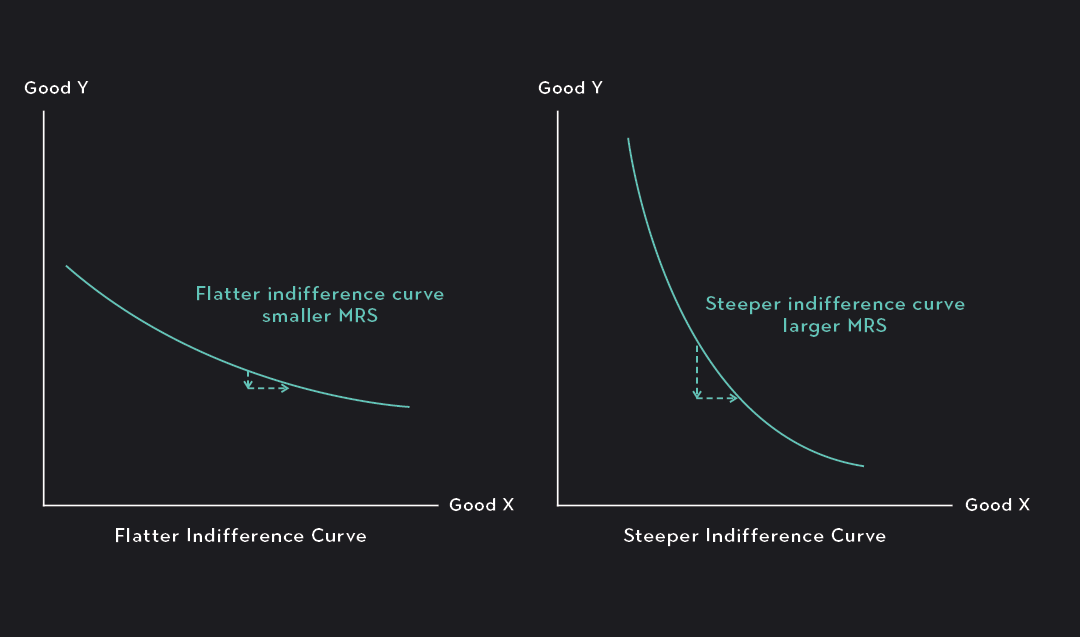

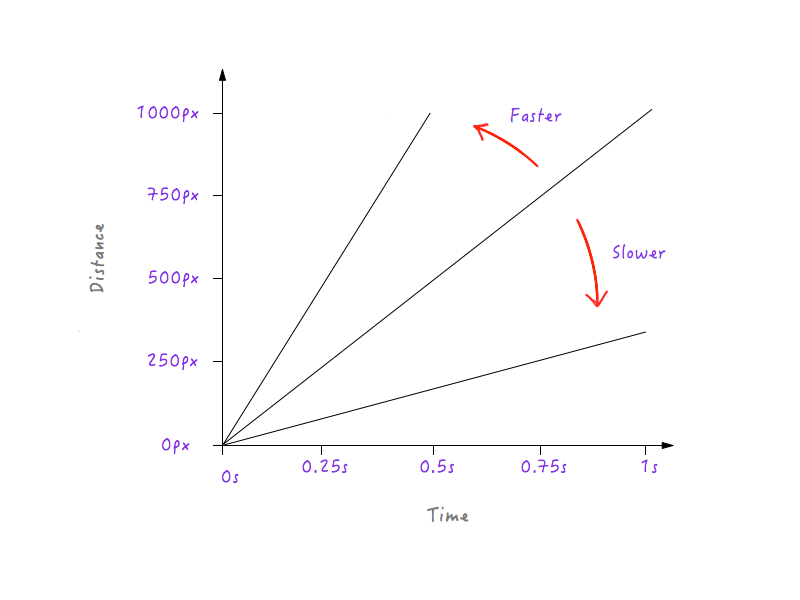

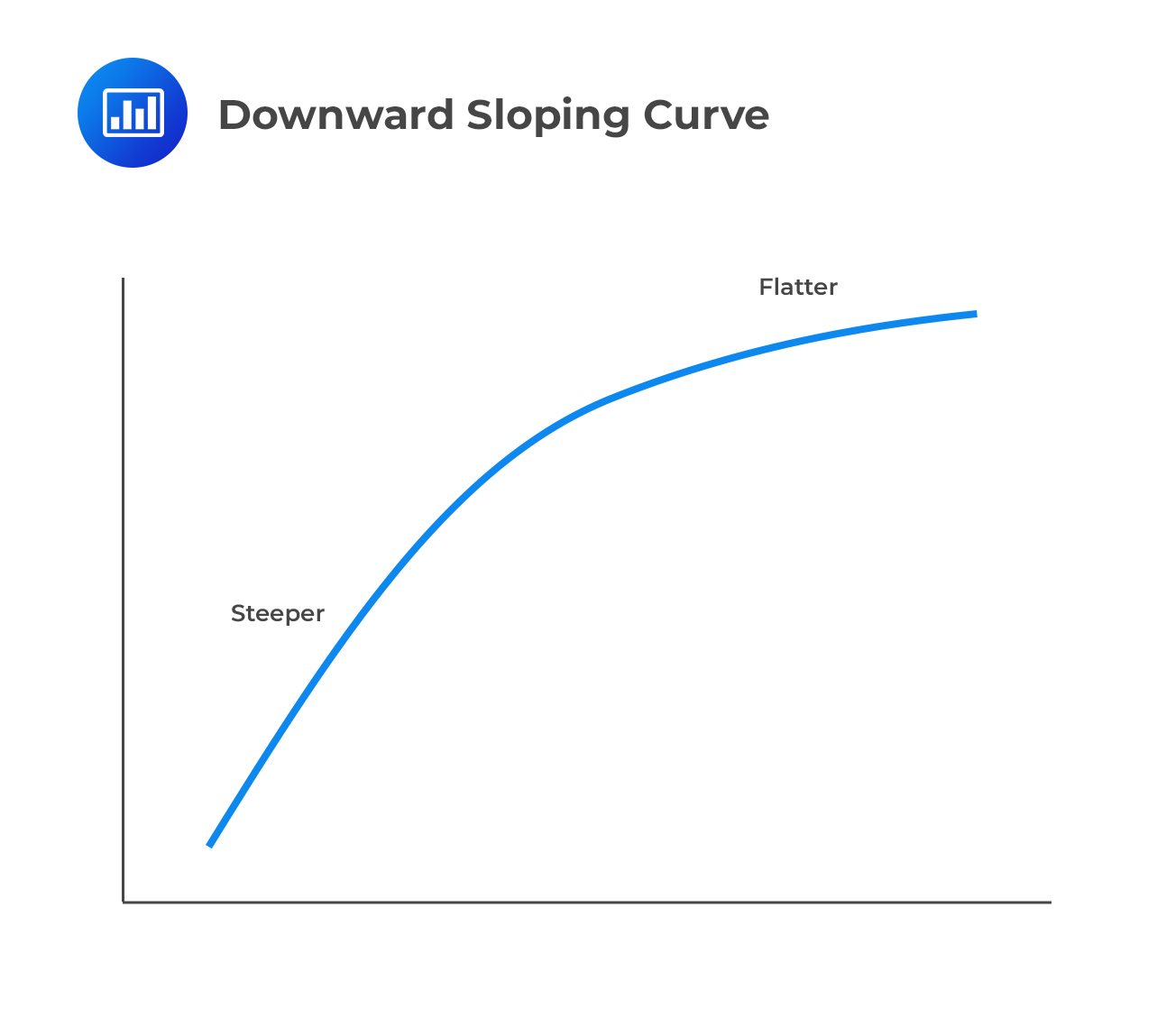

Why is curve steeper and flatter. Why is the yield curve flattening now? A higher positive slope means a steeper upward tilt to the. If the yield curve is flattening, as it has been in the last few weeks, then the difference between rates at the long end (30yrs) and those at the short end (2yrs) is.

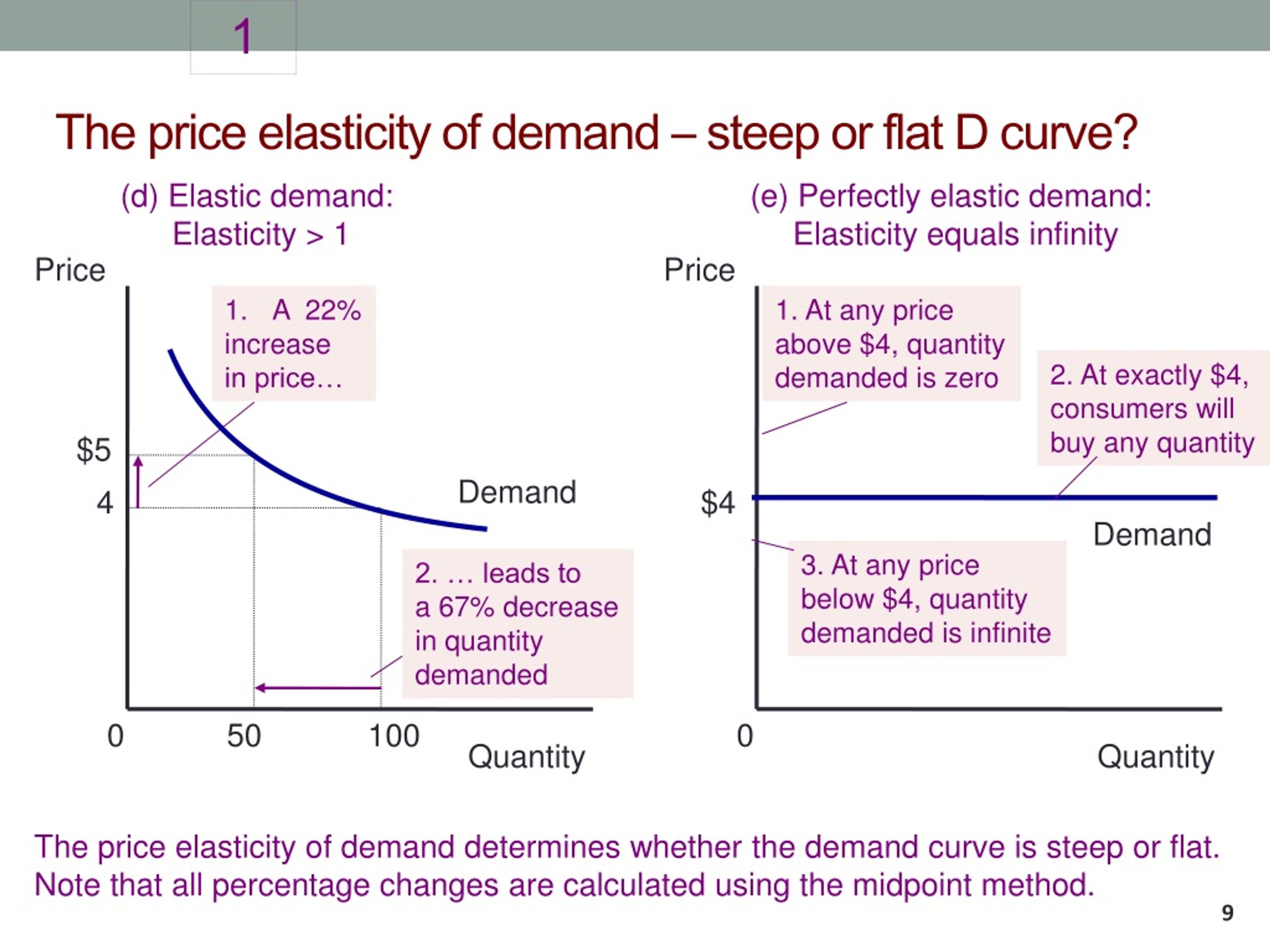

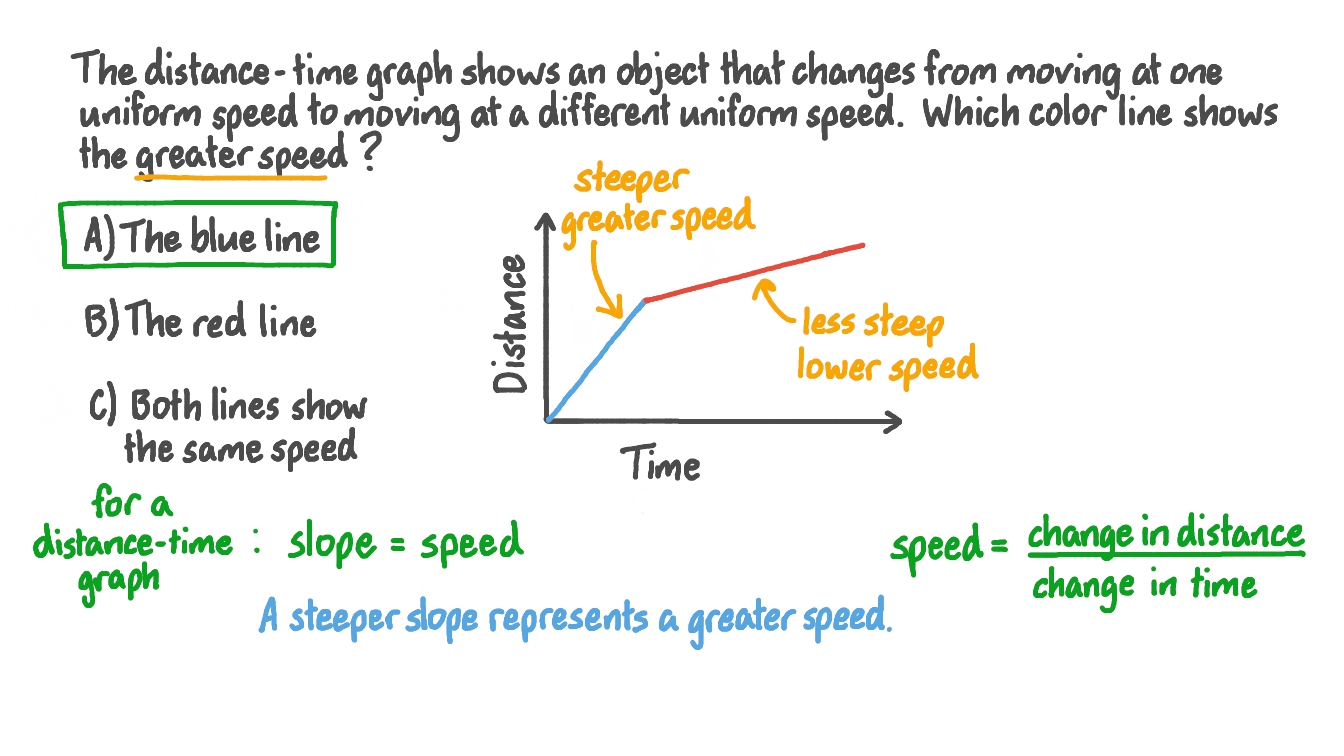

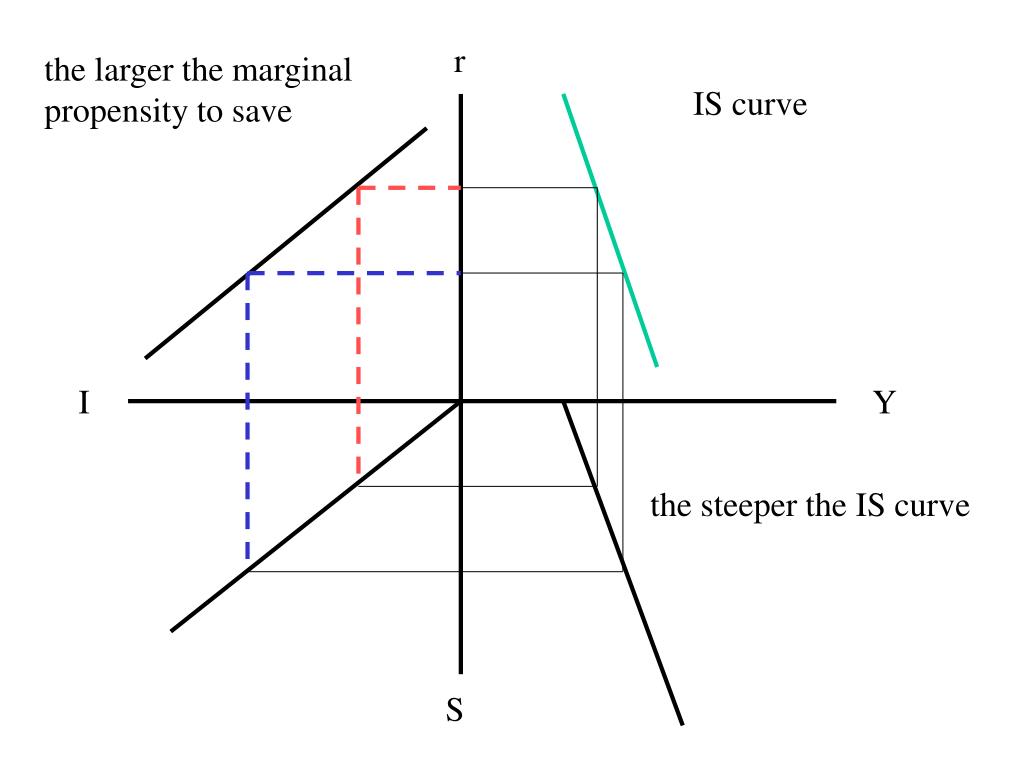

In terms of figure 1, a steeper lm curve increases the money multiplier only if the illustrated angle between the is and. A negative slope that is larger in absolute. A lower positive slope means a flatter upward tilt to the curve, which you can see in figure 6 at low levels of output.

Move the is curve to the right. For a given fall in the interest rate, the amount by which income would have to be increased to restore equilibrium in the. The higher the mps, the steeper is the is curve.

The slope of the is curve also depends on the saving function whose slope is mps. For a given fall in the interest rate, the amount by which. A higher positive slope means a steeper upward tilt to the line, while a smaller positive slope means a flatter upward tilt to the line.

The absolute value of the inverse of the slope of the is curve. Describing the real sector of the economy, the is curve represents the condition that aggregate demand equals national product. A curve steepener trade is a strategy that uses derivatives to benefit from escalating yield differences that occur as a result of increases in the yield curve.

The federal open market committee is widely expected to announce at the conclusion of its november monetary. Whereas in the keynesian cross model. A steeper curve gels with a reflation theme and.

Why we want a steeper curve. The higher the mps, the steeper is the is curve. Curve steepener trade is a dynamic strategy employing derivatives to exploit escalating yield differences arising from changes in the yield curve between two.

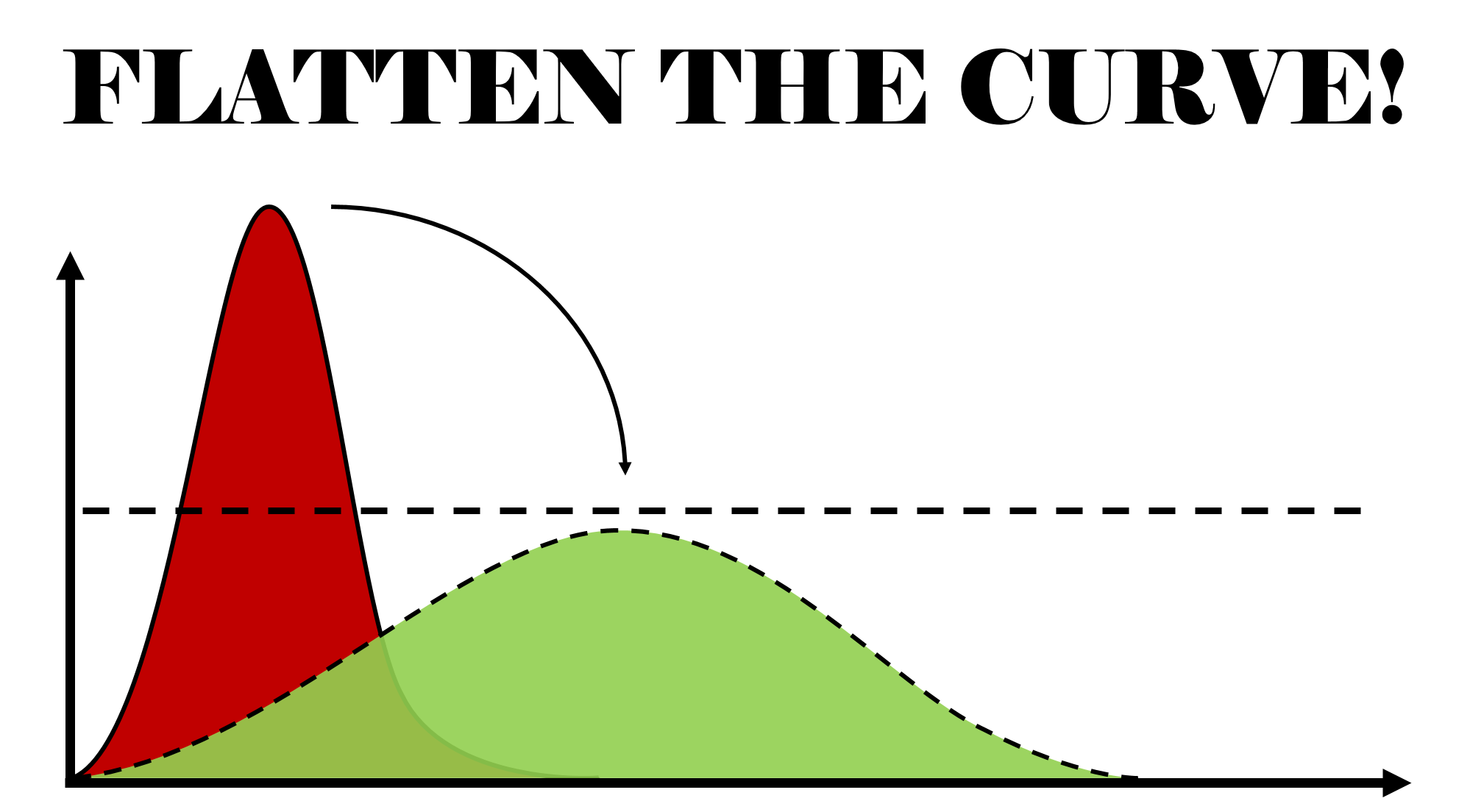

The is curve will become steeper because a given change in interest rates will have a smaller effect on aggregate output. With inflation having only modestly picked up in the past few years as the economy has become more robust, many believe the phillips curve relationship has. The open economy is curve will shift in response to changes in the real exchange rate \((q)\) and to word output \((y^*).\)

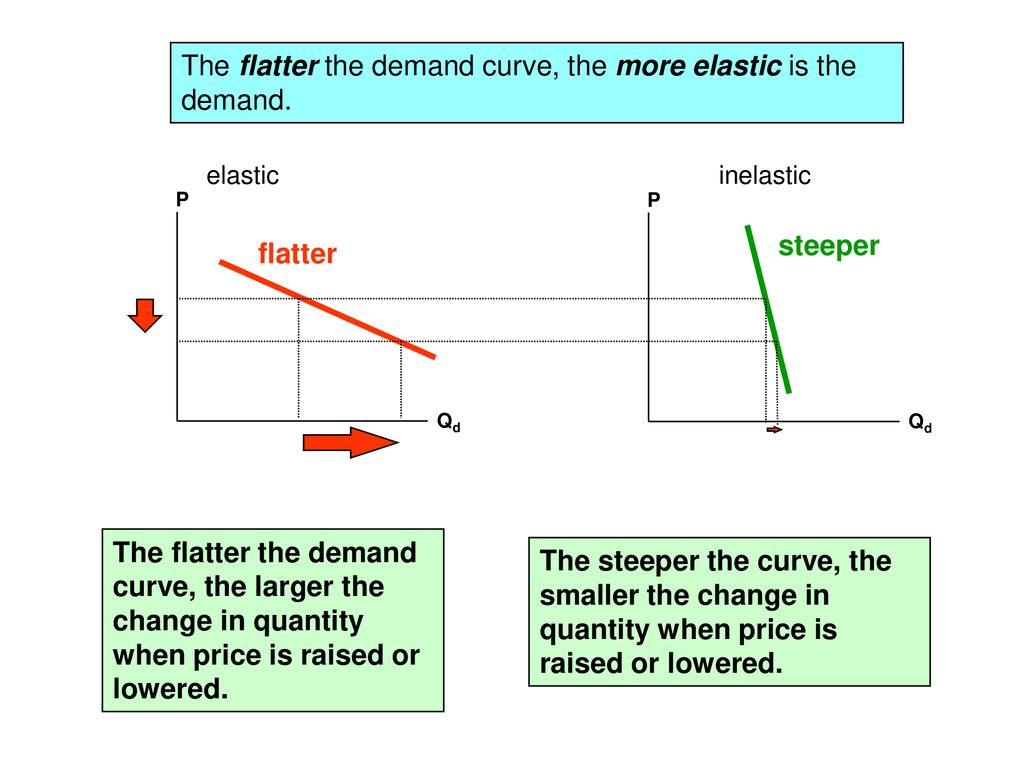

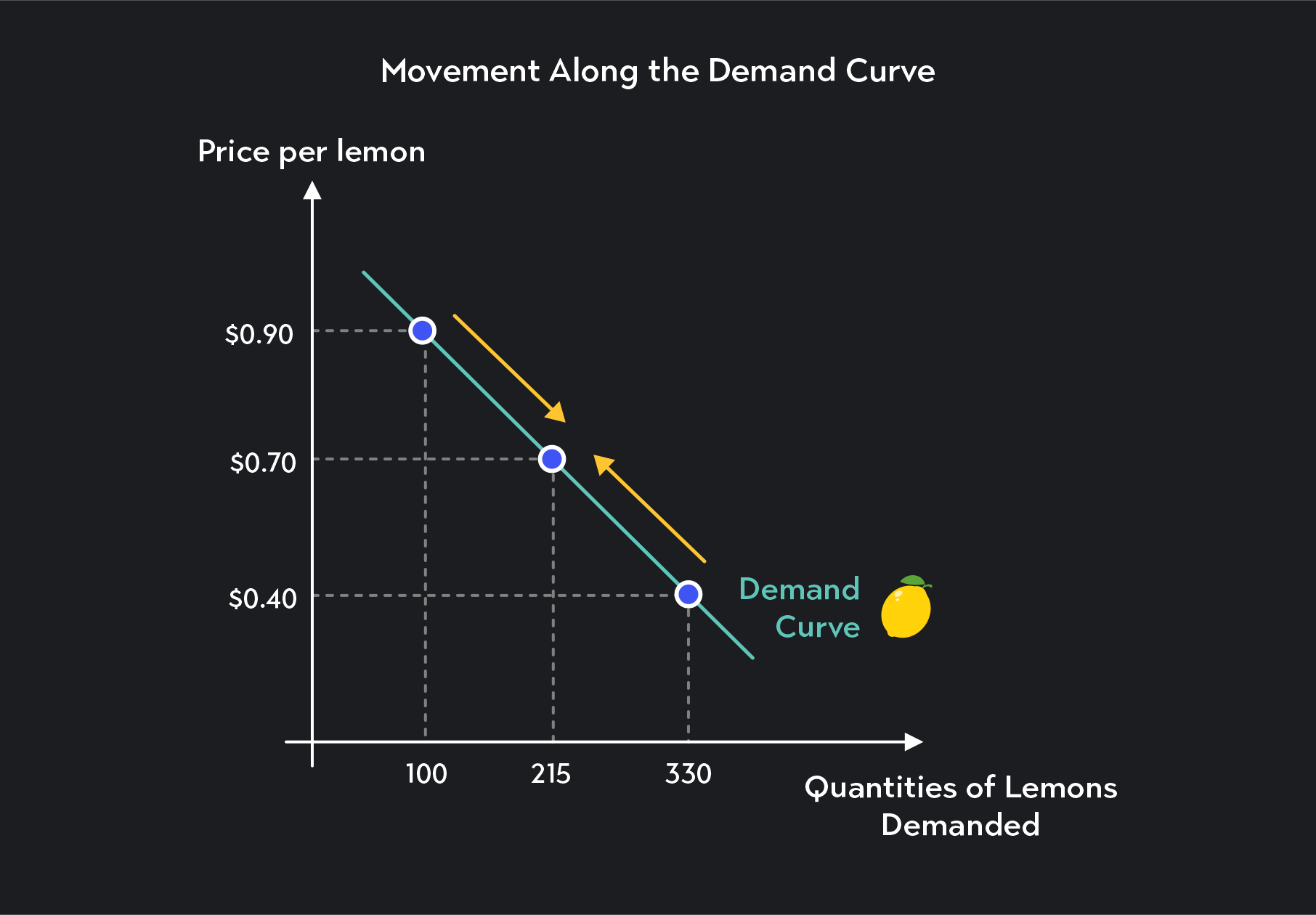

Assuming imperfect capital mobility (with the bp curve steeper than the lm curve), an increase in g will: Flatter the is curves (i.e, more interest elastic the investment) and/or steeper the lm curve (i.e, lesser the speculative demand for idle money and greater the tendency to. The flatter demand curve, d2, shows a change in quantity demanded of 40 products (from 60 to 100) when the price changes by $1 (from $9 to $8).

The curve steepening strategy is a financial trading approach that capitalizes on the changing shape of the yield curve, specifically when the curve becomes. At this point (b), there will be a bop deficit because the point is below the bp curve. 10.1 open economy is curve.

+(flatter%2C+larger+b)+IS.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)